Recovery Begins with a Promise

Start your life in recovery with compassionate, effective treatment at Promises Behavioral Health

There is a better future in front of you—and we’re here to help you discover it.

We help patients recover their lives after substance use disorder at our nationwide family of treatment centers.

Promises Behavioral Health is fully accredited and certified

About Promises Behavioral Health

With its headquarters in Brentwood TN, Promises Behavioral Health is a family of centers nationwide ready to help you achieve recovery. Our highly trained staff throughout our drug rehab centers work to fill in the gaps of treatment. By providing unique options in healing environments, Promises Behavioral Health addiction treatment changes the way we approach recovery. Whether you’re looking for treatment for yourself or for a loved one, our team is ready to help every step of the way.

It doesn’t matter what’s happened up to this point: there is a path to recovery for you

Addiction treatment means making big changes in your life. But you don’t have to make those changes all alone.

Promises Behavioral Health treatment centers provide comprehensive, effective treatment services that support you throughout your entire path to recovery:

- Addiction treatment that works. Our model for treatment is based on the most current evidence-based practices for substance use treatment and co-occurring diagnoses

- Support for doing the work of recovery. Patients have the opportunity to start recovery and healing in safe, judgment-free environments where they are supported by industry-leading professionals and empathetic staff

- Recovery is lifelong. After treatment, patients can find ongoing recovery support through our Rooted alumni groups and other sobriety programs

An approach to recovery that’s rooted in compassion and hope

Your story is important. Your recovery is important. This is the foundation of our relationship with our clients.

We care about your challenges and helping you overcome them.

Our intake process is based on our client-first philosophy. From your very first phone call with us, we’re here to help you break down the barriers to treatment.

Start your recovery with:

- A compassionate, nonjudgmental intake process to determine the right treatment schedule for you

- A no-hassle insurance coverage verification process

- Quick access to treatment, allowing you to start treatment without unnecessary delays or frustrations

Recovery is too precious to risk with unproven methods or anything less than best-in-class professionals.

Our experienced professionals are trained in current, evidence-based therapeutic methods:

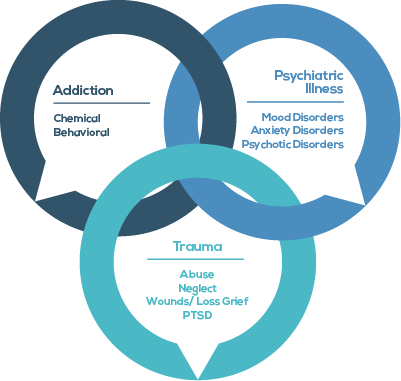

- Trauma-informed care

- Dual diagnosis treatment

- Recovery and relapse prevention

- Nutrition education

- Medication-assisted treatment

The addiction help you need is ready for you

Medical detox

Medical detox provides 24-hour medical monitoring for patients withdrawing from drug and alcohol use.

We focus on ensuring your safety and comfort until you’re mentally stabilized and ready to participate in treatment.

Residential treatment

Now is your opportunity to dedicate your whole self towards healing.

Promises Behavioral Health offers modern facilities with all the amenities you need to feel at home while you do the hard work of your recovery.

Outpatient treatment

A flexible approach to treating your drug and alcohol addiction. With our outpatient programs, you don’t have to interrupt your life to get your life back.

Options include partial hospitalization programs, intensive outpatient programs, and continuing care groups.

Alumni support

Once you’ve completed your treatment program, we support you through our extensive network of alumni groups.

Our alumni groups reinforce recovery skills, provide social and emotional support, and help advocate for addiction awareness.

Mental Health & Addiction Treatment Programs

at Promises Behavioral Health

Personality Disorder

With a residential treatment center for dependent personality disorder, many people with personality disorders can manage their symptoms.

Anxiety Treatment

Our inpatient anxiety treatment centers help people overcome the effects of anxiety disorders.

Trauma & PTSD Treatment

Residential PTSD programs offer a private, secluded place where the emphasis is on treatment.

Non 12 Step Programs

Non 12 step options offer effective treatment for those who feel a 12 step approach isn’t for them.

Mood Disorders

A mood disorder is a medical condition characterized by elevated and lowered moods.

Sex Addiction Treatment

Individualized treatment for sex addiction is crucial to helping clients stay safe and healthy.

Most major insurance providers help cover the cost of treatment

Find out right now if your health insurance benefits can be used to cover substance use treatment at Promises Behavioral Health treatment centers.

Comprehensive, evidence-based addiction treatment centers with locations nationwide

Our effective, client-centered treatment is available no matter where you live. Our treatment centers across the country deliver specialized programs to help you achieve lifelong sobriety.

Promises Behavioral Health

Mental Health Treatment & Drug Rehab Centers

Our various locations throughout the country provide essential mental health and addiction treatment to fit the needs of each client. Promise Behavioral Health offers unique yet effective experiences for those undergoing mental health or addiction treatment. Each location is fully accredited and staffed with a knowledgeable, trained, and compassionate staff.

Promises Five Palms

Ormond Beach, Florida

The Ranch TN

Nunnelly, Tennessee

The Ranch PA

Wrightsville, Pennsylvania

Promises Brazos Valley

College Station, Texas

The Right Step Hill Country

Wimberley, Texas

The Right Step Houston

Houston, Texas

Washburn House

Worcester, Massachusetts

View all Treatment Centers

I need help with substance use for:

Myself

Asking for help is a huge accomplishment. We’re here to support individuals through all stages of their recovery from drug and alcohol addiction.

A loved one

Seeing a loved one struggle with the effects of addiction is painful, but you can help them by helping them access effective, compassionate treatment.

A client

You care deeply about helping your clients get the help they deserve. We offer evidence-based substance use disorder treatments and are committed to open, transparent communication with referring professionals.

Recovery is lifelong—and so is our commitment to yours.

We offer a lifelong support system for individuals wherever they’re at in their recovery.

Starting and during treatment

At Promises Behavioral Health, we support patients even before they join us. Our entire admissions process is designed to get to know you as a person and to reduce the feeling of being overwhelmed.

Aftercare and alumni groups

Our extensive aftercare and alumni groups network connects you with others living in sobriety with alumni events, Facebook groups, and other forms of support to keep you focused on long-term recovery.

The greatest form of courage is to ask for help

No matter where you’re at on your journey to recovery, we’re here to help you.